NEW YORK – As the end of summer nears, hotels in major North American markets are focusing on capturing bookings for early 2016 as opposed to last-minute travel deals, according to data from the August 2015 TravelClick North American Hospitality Review (NAHR).

“Savvy hoteliers and smart travelers are playing the long game, according to the latest TravelClick data,” said John Hach, Senior Industry Analyst at TravelClick. “While there are some short-term dips in demand, capturing strong advance bookings is a best practice for opportunistic hoteliers to increase RevPAR well into 2016. However, it will be interesting to see if and how the recent stock market volatility impacts short-term and advance bookings.”

Twelve-Month Outlook (August 2015 – July 2016)

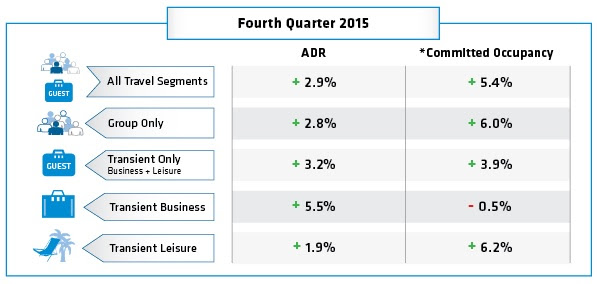

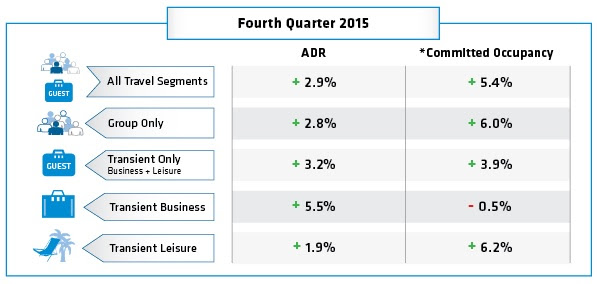

For the next 12 months (August 2015 – July 2016), overall committed occupancy* is up 2.2 percent when compared to the same time last year. ADR is up 2.9 percent based on reservations that are currently on the books. Transient bookings (individual reservations that are made by business and leisure travelers) are up 1.5 percent year-over-year, and ADR for this segment is up 3.4 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is showing occupancy gains of 4.0 percent and ADR gains of 2.5 percent. The transient business (negotiated and retail) segment occupancy is down 1.6 percent, but ADR is up 4.9 percent. Group segment occupancy is up 2.7 percent, and ADR has increased 1.9 percent, compared to the same time last year.

Hach added, “While there are many reasons that hotels are experiencing a relatively flat to slight dip in Q3 demand, it is likely just a small correction, as many travelers booked their trips earlier this summer. However, the strong dollar cannot be ignored, as it is becoming more expensive for people who live in Europe and Asia to visit the U.S.”

The August NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by August 5, 2015, from the period of August 2015 to July 2016.

*Committed Occupancy – (Transient rooms reserved + group rooms committed)/capacity

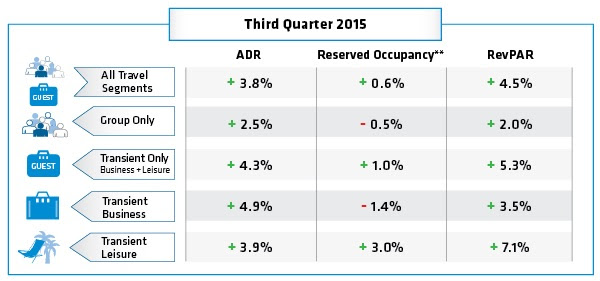

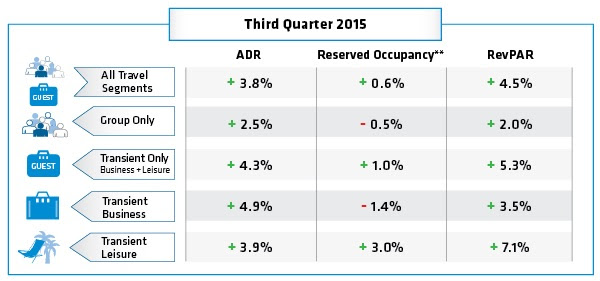

**Reserved Occupancy – Total number of rooms reserved/capacityThe third quarter combines historical data (July) and forward-looking data (August – September).

“Savvy hoteliers and smart travelers are playing the long game, according to the latest TravelClick data,” said John Hach, Senior Industry Analyst at TravelClick. “While there are some short-term dips in demand, capturing strong advance bookings is a best practice for opportunistic hoteliers to increase RevPAR well into 2016. However, it will be interesting to see if and how the recent stock market volatility impacts short-term and advance bookings.”

Twelve-Month Outlook (August 2015 – July 2016)

For the next 12 months (August 2015 – July 2016), overall committed occupancy* is up 2.2 percent when compared to the same time last year. ADR is up 2.9 percent based on reservations that are currently on the books. Transient bookings (individual reservations that are made by business and leisure travelers) are up 1.5 percent year-over-year, and ADR for this segment is up 3.4 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is showing occupancy gains of 4.0 percent and ADR gains of 2.5 percent. The transient business (negotiated and retail) segment occupancy is down 1.6 percent, but ADR is up 4.9 percent. Group segment occupancy is up 2.7 percent, and ADR has increased 1.9 percent, compared to the same time last year.

Hach added, “While there are many reasons that hotels are experiencing a relatively flat to slight dip in Q3 demand, it is likely just a small correction, as many travelers booked their trips earlier this summer. However, the strong dollar cannot be ignored, as it is becoming more expensive for people who live in Europe and Asia to visit the U.S.”

The August NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by August 5, 2015, from the period of August 2015 to July 2016.

*Committed Occupancy – (Transient rooms reserved + group rooms committed)/capacity

**Reserved Occupancy – Total number of rooms reserved/capacityThe third quarter combines historical data (July) and forward-looking data (August – September).